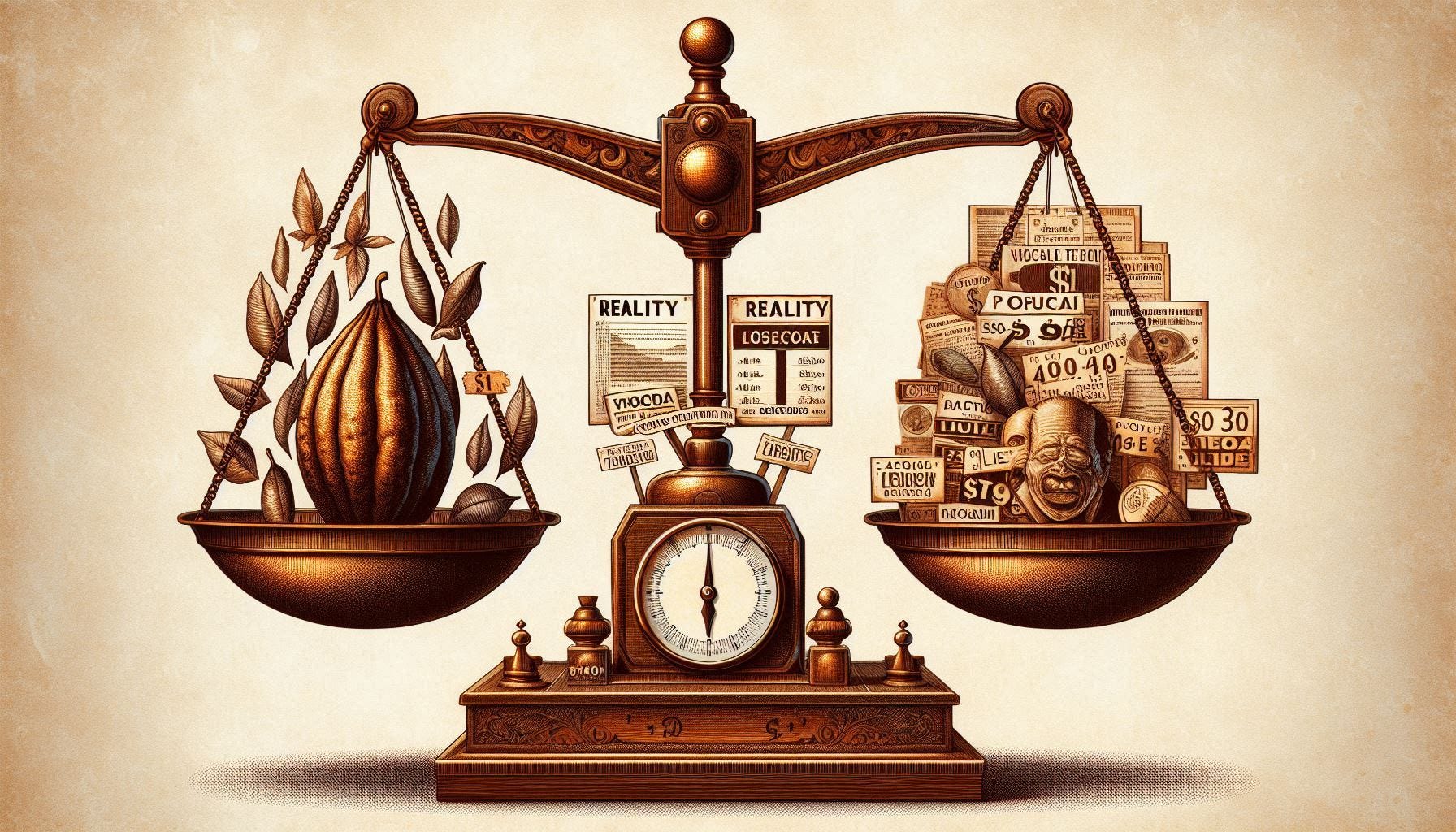

A Strategic Move or Bad Faith Posturing -Ghana Cocoa Board's hift from sourcing International Loans to finance local cocoa purchases

In all my years in the cocoa-chocolate sector, one of the most frustrating observations I've made is how reverse psychology is often employed in bad faith. It's used to justify reactionary moves and political rhetoric, all while exploiting the public's lack of awareness about our underlying mistakes and ineptitude. This is what inspired me to start writing. Recently, news broke that Ghana has ended a 32-year tradition of seeking international loans to finance its cocoa purchases. However, the story is more complex than it appears. While some reports suggest that COCOBOD, the entity responsible for cocoa in Ghana, has boldly decided to ditch international loans in finance the 2024/2025 cocoa season, others asserted that COCOBOD’s $1.5 billion loan request was rejected by international banks, forcing them to seek alternative funding. So in this article I will explain to you what the Syndicated loan and the history of seeking international loans to finance our cocoa beans

The Genesis of the Syndicated Loan

To understand COCOBOD's financial decisions, it is essential to first understand the role of syndicated loans. A syndicated loan is a type of financing where multiple lenders come together to provide funds to a single borrower, typically used for large-scale projects where the required amount exceeds the capacity of a single lender. While such loans can be sourced domestically or internationally, Ghana has historically focused on raising syndicated loans from international sources, particularly in the cocoa sector, due to the significant capital required and the global nature of the trade.

In the context of Ghana's cocoa industry, COCOBOD annually raises syndicated loans to finance the purchase of cocoa beans. The process involves negotiating with a consortium of international banks to secure the necessary funds. Once an agreement is reached, the loan is syndicated, meaning that a group of banks commits to providing portions of the total loan amount, thereby sharing the risk and reward. Local banks in Ghana also play a crucial role, sometimes contributing to the loan and most times managing transactions, ensuring the funds are available when needed, and supporting the purchase of cocoa beans during the harvest season. This process has been vital for maintaining liquidity in the sector, allowing COCOBOD to buy cocoa beans from farmers at stable prices, which in turn supports the livelihoods of these farmers and sustains the industry’s growth.

Why Were They Taking Loans in the First Place?

Ghana's reliance on syndicated loans, particularly in the cocoa sector, is primarily driven by the need to secure large amounts of capital quickly and efficiently to finance the purchase of cocoa beans during the harvest season. The seasonal nature of cocoa production requires significant upfront funding to ensure that COCOBOD can purchase beans from farmers at prices determined by Ghana Cocoa Board (not the farmer ie. Being the regulator, buyer and price determiner. Doing the exact colonial commodity market practices we seek to stop). The large scale of these financial requirements often exceeds the capacity of domestic banks alone, making international syndicated loans a practical solution.

Moreover, by opting for syndicated loans, Ghana can access a wider pool of financial resources, tap into favourable interest rates, and share the risk among multiple international and local financial institutions. This diversified risk is particularly important in a sector as volatile as agriculture, where market prices can fluctuate widely. The international nature of these loans aligns with the global trade of cocoa, enabling COCOBOD to maintain a steady flow of capital to support the entire Ghanaian value chain from production to export.

Another key advantage for COCOBOD in seeking syndicated loans from international sources is the benefit they gain from the depreciation of the Ghanaian cedi against the U.S. dollar. When COCOBOD secures a loan in dollars, they purchase cocoa beans from farmers in Ghana cedis. Given the historical average depreciate rate of the Ghana Cedi by about 20% year on year since 1992, the value of the Ghanaian cedi tends to depreciate against the dollar. This depreciation means that, over time, COCOBOD needs fewer dollars to buy the same amount of cocoa beans in cedis, as the local currency loses value. It’s kind of robbing Peter to pay Paul. In this case peter is the farmer. So cocoa beans are bought from farmers a reducing when currency depreciation and inflation are factored into it producer price.

Since COCOBOD repays the loan in dollars and sells the cocoa beans internationally (often receiving payment in dollars or the Ghana Cedi equivalent), they effectively protect themselves from exchange rate or forex-related losses. In fact, the depreciation of the cedi works in their favour, allowing them to generate more cedi revenue from their dollar sales while having to pay less in dollar terms for their local purchases. This exchange rate advantage allows COCOBOD to accumulate more money, which can be used to cover interest payments on the loan or to reinvest (if they want to, you know what I am talking about) in the cocoa sector. If COCOBOD were to source these funds locally in Ghanaian cedis, they would avoid forex issues, but the high-interest rates in Ghana would make this approach unsustainable.

Keep reading with a 7-day free trial

Subscribe to Cocoa Diaries Newsletter to keep reading this post and get 7 days of free access to the full post archives.